How Banks Could Get a Hold of Your Home

Selva Freigedo, Analyst, The Gowdie Letter

Let’s face it; your kids have it tough.

Job security and affordable homes are out of reach for most young Australians.

Sydney’s median house price is close to $1 million. The average mortgage for first time buyers in New South Wales is about $424,000…up 36% since 2011.

In 1975, it took four times the median household income to buy a home.

Today, that figure is 12 times.

The more property prices go up, the more pressure first time buyers feel to get on the ladder.

But saving the 20% deposit is a huge hurdle. And even with a deposit, most property prices in buyers’ preferred neighbourhoods are out of reach.

That’s why many first home buyers are increasingly asking mum and dad for help.

Research from ME Bank showed that, in the last five years, one in five mortgage holders had some form of assistance from their family. Many received a loan, or a cash gift.

But others helped their children buy their first home by acting as a guarantor.

What is a ‘guarantor’ loan?

It allows the borrower to use another person’s equity (usually the parent or other close family member) as collateral for their loan. The borrower can then access a larger loan without a deposit. They also avoid paying thousands on Lenders Mortgage Insurance.

The amount of equity required from the guarantor depends on the value of the property the borrower wants to buy. In fact, guarantor loans are now the only way to borrow the full purchase price plus costs.

That means your kid can borrow 105% of the property’s value. Some lenders may even loan them a little extra to consolidate a small credit card debt or fund renovations to the property.

Now, these loans that large banks and smaller lenders offer are usually for first home buyers. But some people use guarantors to fund an upgrade to their existing home, or to purchase a second property.

There are no direct financial benefits in

being a guarantor — only risks

being a guarantor — only risks

A guarantor generally needs enough equity in their existing property to cover at least 20% of the price of the newly purchased property.

Most borrowers use this type of loan with the idea that, once they’ve bought their first home, they can refinance and buy more investments.

Now, I bring this up for a reason. I’ve seen it all before.

You see, guarantor loans were very popular in Spain during the property bubble of 1997–2007.

Like Australia today, it was the only way for many people to buy their first home. Property values rose six times higher than the average salary. It effectively priced 60% of the population out of the market.

An increase in foreigners purchasing property (from 0.5% in 1981 to 12% in 2012), low interest rates and free flowing credit combined to spur prices. Sound familiar?

The dream of owning a home turned sour in 2007 when property prices in Spain came crashing down.Property values have since fallen almost 55%. It’s almost impossible to sell at the price you bought.

52% of people who bought their homes in Spain between 2005 and 2007 have already defaulted on their debt and had their homes repossessed. And no, that’s not a typo.

The default rate is 52% for homes bought at the height of the property bubble. According to Spain’s central bank, 70% of evictions during 2013 were for occupied properties bought in 2007 or earlier.

That number climbed to 87.6% in 2014.

The EU has often questioned bank repossessions in Spain. As property values fall, repossessed homes are auctioned at very low prices.

It leaves the borrower with no home and a considerable part of the mortgage to repay.

The ‘lucky’ ones — the ones with a guarantor — have no debt to repay. But they lose two properties: theirs, and their parents’.

Meanwhile, Spanish banks accumulate a large property portfolio, plus all the gains from the mortgage payments made in previous years.

According to the Platform for People Affected by Mortgages, there were 110,140 evictions in Spain between 2012 and 2014 — an average of 100 a day.

With statistics like that, it’s not surprising that suicide is the leading external cause of death in Spain.

But remember — it´s different in Australia

Or Is it?

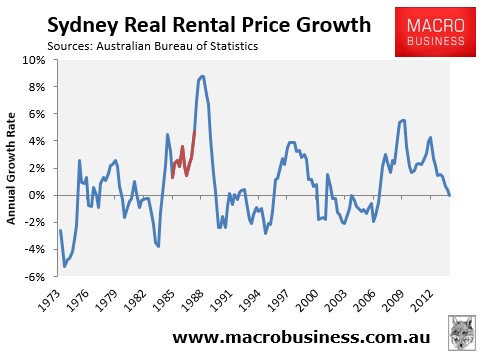

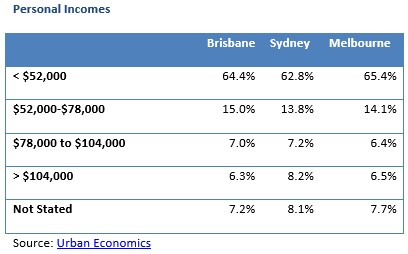

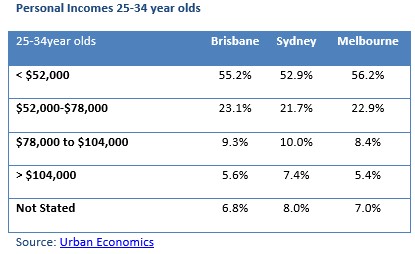

While house prices have increased exponentially, wages have not. In 2014, Australia had the third highest house price to income ratio in the world. Sydney house prices rank only second to Hong Kong in the house unaffordability stakes.

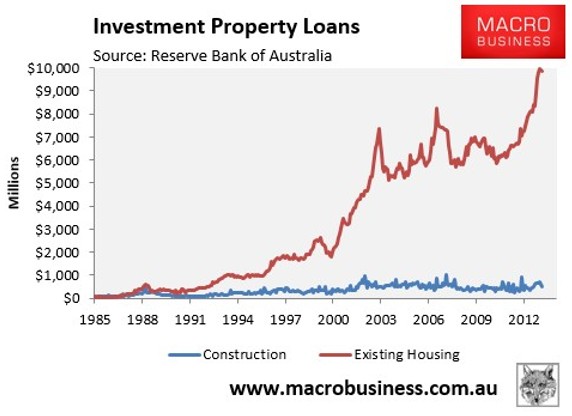

Average new loan values for first home buyers have risen 23% over the last two and a half years. Buyers are taking on more cheap debt while interest rates are at record lows (low rates improve affordability as they lower borrowing costs). But this only makes loans riskier.

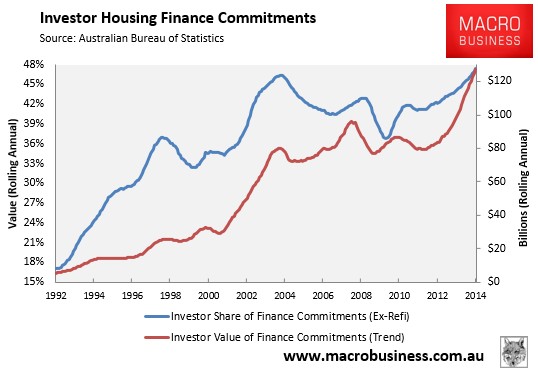

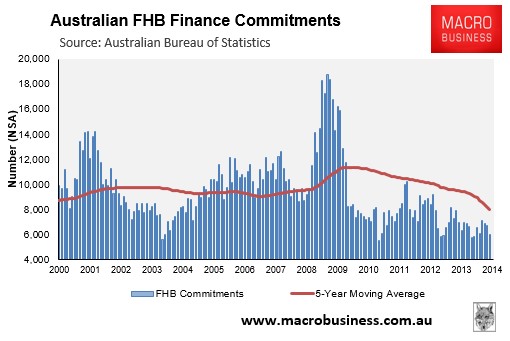

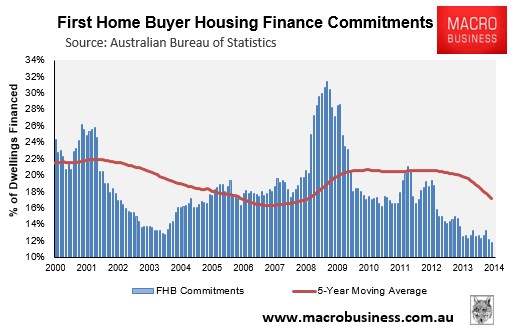

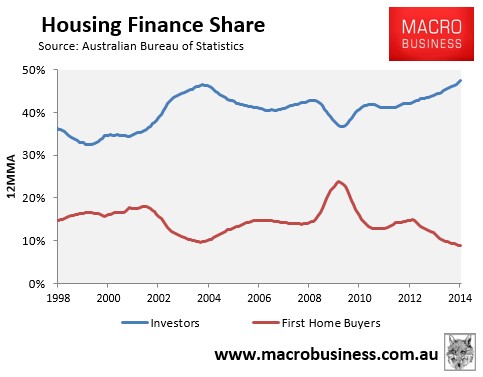

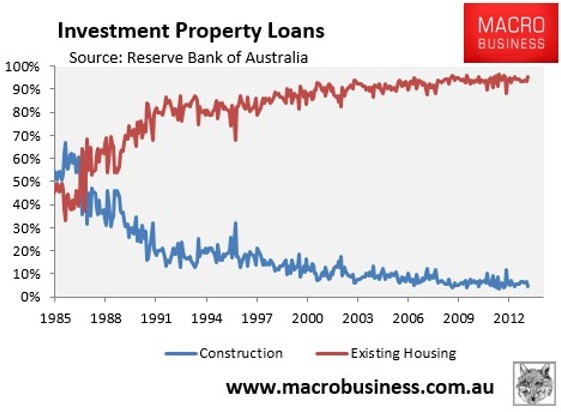

Australian banks are tightening lending conditions for investors in an effort to help first home buyers. As investors start to withdraw from the market, the property supply will increase, while prices decrease.

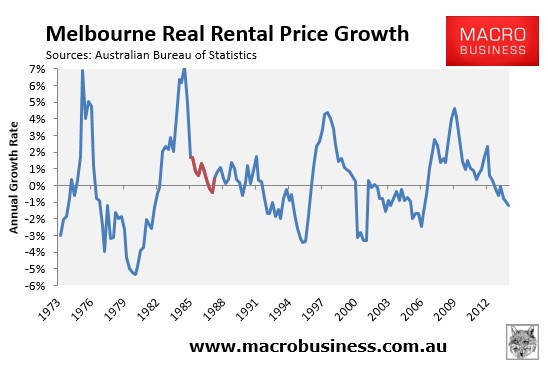

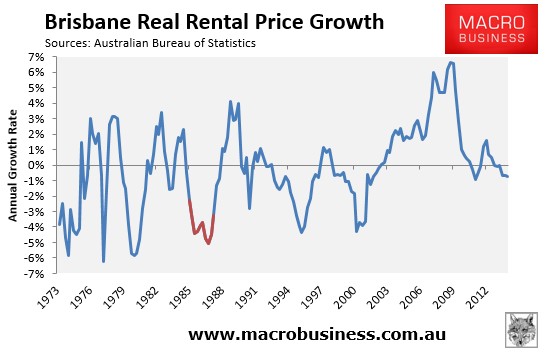

We’re already seeing the housing market slowing down in major cities.

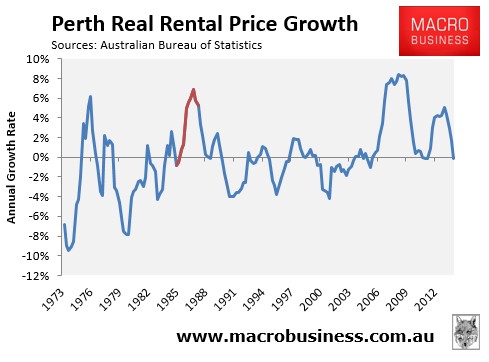

In Melbourne, apartments purchased off-plan lost 11.5% of their value in their first year. Perth has experienced the biggest falls in property prices due to the mining downturn.

The Reserve Bank has just announced that it will keep interest rates low, but for how long?

Purchasing a property is a 25–30 year investment. What happens when interest rates — and mortgage payments — go up?

What if one of your children lost their job, got divorced or, worse still, became sick?

Any negative changes in circumstances could prevent them from keeping up with the repayments.

Guarantor home loans may allow your kids to take the leap from renting to ownership sooner…but they can also ruin your financial life…and theirs.

And if the value of the property falls, it will not cover the amount borrowed. Then the risk of losing your own home becomes a real possibility.