Mr Chanos rose to fame in 2000-01 when he identified flaws in Enron Corporation’s accounts, resulting in management significantly overstating the company’s earnings. Chanos began short selling Enron and made massive profits as the company’s stock declined from $90 in August 2000 to a low of nearly $1 near the end of 2001. Chanos’ ability to find and then exploit the fraud at Enron has made him somewhat of a celebrity in the financial press.

In his latest interview, Chanos warns that China is experiencing a severe real estate bubble and is headed for a crash; rather than the sustained boom that most mainstream economists predict.

Chanos first defines what he means by a bubble: a debt fuelled asset inflation where the rental income does not cover the debt expense incurred to purchase the asset. In other words, ‘Ponzi finance’ that requires the ‘greater fool’ and ever-increasing levels of debt to perpetuate it.

After watching Chanos’ interview, I thought I’d examine how Australia’s residential housing market stacks up under his definition in order to determine whether we are experiencing a speculative housing bubble or asset inflation based upon sound fundamentals.

Up, Up and Away:

Anyone under the age of 40 and living in an Australian capital city knows first hand that it is becoming increasing difficult to find a decent, reasonably priced home within a reasonable commute to work. We’ve all watched in amazement, disbelief or dread as we, our friends or family are priced-out of the housing market or take on mortgages the size of a small African nation simply to put a roof over our head. But how expensive have Australian house prices become? Where has the money come from? And is this house price growth sustainable?

To answer the first question, Chart 1 plots average Australian established house prices (sourced from the Real Estate Institute of Australia) against average Household Disposable Incomes (HDI) and Average Full-Time Ordinary Earnings (AFTOE).

As you can see, the ratio of house prices to average earnings started at around 2.5 times HDI and 3.7 times AFTOE in 1986. This ratio increased slowly from the mid-1980s to 2000, rose rapidly from 2000 to around 2004 and then settled at around 6 times HDI and 7.7 timed AFTOE in 2008/09.

While you can argue about the choice of house price data and income measures, the fact remains that the trend in prices is clear – housing has become far more expensive overtime and Australians are now required to dedicate a much larger proportion of their lifetime’s earnings to purchase a home.

Buy now, pay later:

Since the growth in house prices has significantly outpaced the growth in incomes, it follows that rising debt levels have been the key contributor to rising house prices in Australia, since the only way to purchase something that you cannot afford through income is to borrow the difference. Chart 2 uses RBA data to plot the level of mortgage debt against HDI and GDP.

Based on the above data, we can confidently conclude that Australia’s house price growth has been debt-fuelled, thereby fulfilling the first criterion of Chanos’ bubble definition.

If you can’t buy it, rent it:

So what about the second part to Chanos’ bubble definition – the requirement that the rental income does not cover the debt expense incurred to purchase the asset, thereby requiring ‘Ponzi finance’ and ever-increasing levels of debt to sustain asset (house price) growth?

To determine whether this part of Chanos’ definition has been met, Chart 3 uses ABS data to plot the growth in real (inflation-adjusted) house prices against the growth in real rents. For this criterion not to hold, we would require rents to have increased at roughly the same rate as house prices such that rental incomes broadly cover the cost of debt repayments.

Ouch! According to the ABS, real rents have increased by only 14 per cent since 1987 while real house prices have risen by a whopping 163 per cent over the same period! It is no surprise then that yields on rental houses have plummeted from around 8 per cent in 1987 to around 3.5 per cent currently (Chart 4).

Remember that the rental yields shown above are before deductions for property expenses such as rates, land tax, maintenance and agents fees. If you take these costs into account, then current net rental yields would likely be tracking around 2.5 per cent, well below the current discount variable mortgage rate of around 7 per cent. Put another way, the average new housing investor would incur a pre-tax income loss of around 4.5 per cent on every dollar invested in housing!

The data, therefore, strongly suggests that the Australian housing market is being underpinned by Ponzi finance, whereby investors and owner occupiers are leveraging up to buy property in the hope of achieving rapid capital growth (in the case of investors) or ‘getting in’ before prices increase further (in the case of owner occupiers). With the significant negative income returns from residential property, the only way that house prices can continue to increase faster than incomes is if buyers continue to believe that prices will rise and that large capital gains can be made by selling the same asset to other buyers (the ‘greater fool’). Such a scenario requires ever-increasing debt levels, which is clearly unsustainable.

This hypothesis is broadly supported by this recent investigation by the Economist, which found Australia’s housing market to be the most overvalued in a sample of 20 countries using an average price-to-rents methodology. Similarly, the IMF recently found the Australian housing market to be amongst the most overvalued in the OECD based on price-to-rents and price-to-incomes (click here).

Aussies love a punt:

So who is to blame for the rising debt levels and spiralling house prices? Is it the property investors encouraged to pile into rental housing by Australia’s peculiar tax laws? Is it owner occupiers that simply expect too much and are willing to pay any price to buy the home of their dreams? Or is it the banks for providing easy credit?

In my opinion, all factors are to blame. It is certainly true that investors have significantly added to housing demand and prices over the past two decades, as evidenced by investors’ share of total mortgages increasing from around 14 per cent of total mortgages in 1990 to around 30 per cent currently (Chart 5).

And thanks to negative gearing - which allows landlords to deduct interest and other expenses against other income for tax purposes, without limit - the number of property investors claiming rental losses has skyrocketed. According to the 2007-08 Australian Taxation Office Statistics, there were around 1.7 million property investors claiming deductions in 2008. Of these, 1.2 million, or 69 per cent of property investors (1 in 10 taxpayers) claimed net rental losses, with total net rental losses equalling a massive $8.6 billion! By comparison, there were around 1.1 million property investors claiming deductions in 1995-06, with 56 per cent of these claiming net losses.

The impact of negative gearing on encouraging property speculation was also compounded by the Howard Government’s decision to halve the rate of capital gains taxes in 1999. Taken together, these two tax measures enable property investors to partly socialise any losses incurred through holding investment property, whilst privatising any gains achieved through capital appreciation.

Of course, some increase in investors was to be expected, even without the generous tax concessions, given the Baby Boomer generation – the largest generation in history – began to hit peak earnings age (45 to 55 years) from 1990. And as the Boomers and others realised that they had not saved enough for their retirement, they began buying up investment properties on masse as a way of catching up in a hurry, helped along of course by a proliferation of tacky property investment seminars marketing slogans like: “THIS WEEKEND CAN MAKE YOU A MILLIONAIRE” and continuous segments on tabloid television showing every man and his dog making fortunes on the back of property.

Keeping up with the Joneses:

Owner occupiers don’t escape blame either. Thanks to our unspoken desire to impress our neighbours, colleagues and friends, there has been a remarkable increase in the size of our homes. According to Clive Hamilton’s book Affluenza, and reiterated in Ross Gittins’s book Gittinomics, between 1985 and 2000, the average floor area of new houses increased by almost a third, while the average number of people per house has decreased from 3.60 in 1960 to around 2.56 in 2008 (see my previous post). So we, as a society, have been prepared to pay more for larger, better quality homes; although, some of this increase in the size (price) of our houses has been partly offset by a reduction in the size of the average block of land.

The Baby Boomers reaching peak earnings age from 1990 is also likely to have significantly increased demand (and prices) for owner occupier homes, since many in this demographic would have traded up to their most expensive (‘peak’) home over this period.

Finally, we cannot forget the significant role that government policy – in particular the introduction of the First Home Owners Grant in 2000 and the more recent First Home Owners Boost – played in enticing first-time buyers into the market and significantly boosting housing demand. Combined with elevated levels of competition from property investors and runaway house prices, first time buyers have increasingly felt the need to leverage up with debt in order to ‘get on the property ladder’ before prices rise beyond their reach.

If you can’t borrow the money, you can’t pay a high price:

While there are many factors that have increased the demand for housing - such as tax concessions, subsidies paid to first-time buyers, and Baby Boomer Demographics – in the end, the extra demand for housing can only feed into higher prices if credit is readily available, enabling buyers to borrow large sums and pay high prices. Put simply, the supply of credit is the crucial ingredient to sustaining high house prices.

As explained in the excellent book, The Great Crash of 2008, it was the rise of the non-bank lender in the mid 1990s - raising funds via securitisation activities on the wholesale debt markets - that initially caused an intensification of competition among mortgage lenders (Chart 6 tracks their growth against bank mortgage lending). It was these non-bank lenders, whom have no formal regulator and no rules outside of regular trade practices and corporations law, which led the decline in Australian credit standards from the mid 1990s by introducing ‘innovative’ loan products like low-doc loans in 1997, then ‘no-doc’ loans in 1999, and more recently they were beginning to issue ‘non-conforming’ (subprime) loans just before the Global Financial Crisis intervened.

Faced with this new competitive threat, the banks responded in kind by reducing their deposit requirements and tapping new sources of funding offshore. Gone were the days of requiring a minimum 20 per cent deposit and the banks funding their loan portfolios from domestically sourced funds (mostly deposits); instead, 5 per cent deposits became commonplace funded increasingly by the banks issuing bonds to foreigners.

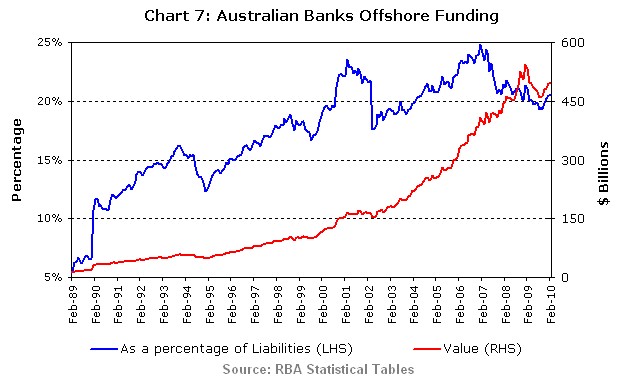

As shown in Chart 7, the percentage of bank liabilities funded from foreigners has increased from just over 5 per cent in 1989 to around 22 per cent currently, totalling nearly $500 billion! Over the same period, the banks increased the proportion of loans channelled into housing, with housing loans increasing from around 35 per cent of total lending in 1990 to 56 per cent in 2010.

Anyone seeking an answer as to why Australia owes so much money to foreigners only has to look to the contemporary banking model of borrowing offshore to pump up housing (Chart 8).

With the banks awash with funds - sourced from both domestic and foreign sources - and with a higher proportion of bank assets (loans) being directed into housing, is it really a surprise that house prices and household debt has exploded over the past two decades?

The key risk is that Australia’s ability to sustain current house prices, let alone further price increases, rests with the willingness of other countries to continue lending the banks money. But in times of crisis, such as when Lehman Brothers collapsed, foreigners tend to zip up their wallets, leaving our banks, house prices, and broader economy exposed to a sudden liquidity shock as the banks are unable to roll-over their foreign borrowings (let alone increase them).

Few people realise that the Australian Government’s October 2008 guarantee of bank funding and deposits was issued after the larger banks made it clear to the Government that they were facing extreme difficulty in rolling over their wholesale funding, meaning that they would have to immediately withdraw credit from the Australian economy and would eventually face insolvency. So while it might be true that Australia’s banks managed credit risk well, avoiding the excesses of the sub-prime lending prior to the onset of the GFC, their heavy offshore borrowing created a liquidity risk that also rendered them too-big-to-fail, eventually leading to the Government’s funding guarantee. Hence, whilst North American and European banks became insolvent on the asset side of their balance sheet, due to holding dodgy loans and derivatives, our banks also faced insolvency, except that it was on the liability side of their balance sheet (a more detailed discussion of this issue is provided in the book, The Great Crash of 2008).

Bubble Trouble:

Contrary to popular opinion, the Australian housing market is currently in a fragile position. With Australian household’s already up to their eyeballs in debt and housing finance falling (particularly amongst first-time buyers), it is difficult to see how prices and debt levels can continue their upward trend. Even without an external shock, such as a China slowdown or a liquidity crisis that prevents the banks from rolling over their offshore debt, for prices to continue rising, investors and owner occupiers must continue to believe that capital appreciation will be sufficient to cover the negative income return from owning residential property. This is clearly an unsustainable situation and once the expectation of continued strong house price growth disappears, households will likely start to reduce their borrowings (deleverage) and prices will correct.

A greater concern is that an external shock leads to a steep rise in unemployment and/or a credit crunch. If such an event occurs, we can expect a house price crash and a prolonged period of debt deflation, similar to the experience of the USA and Europe following the GFC.

Although it won’t admit it, the Government is aware of these risks, which is why it implemented policies to sustain the housing bubble during the GFC, including: the First Home Buyers Boost; liberalised foreign investment rules; funding for mortgage securitisation by non-bank lenders; bank deposit and wholesale funding guarantees; and the current massive immigration program. These policies are clearly aimed at increasing housing demand and ensuring a steady supply of credit – the two key ingredients for continued growth in house prices and debt. But most of these policies are likely to work only once and have merely delayed the inevitable correction we have to have.

For their part, the banks are continuing to channel funds into housing. Following the GFC, the large banks cut lending to business and apartment developers (thereby reducing supply), and instead directed these funds to purchasers of existing dwellings. Further, after realising that households had reached the limits of their debt servicing capacity, ING – Australia’s fifth largest lender – is now preparing to issue never-ending mortgages that have no fixed term and no requirement to repay any capital along the way, in a bid to reduce monthly loan repayments (see here for details). We can expect other lenders to follow suit in a desperate bid to encourage households to continue borrowing larger sums in order to sustain our overinflated house prices.

The government and banks will no doubt try anything to keep the housing Ponzi scheme alive and prevent the housing bubble from bursting. But for how long can the Australian housing market defy gravity?