Recent article by a respected economist. Well worth a read.

Saul Eslake: 50 Years of Housing Failure

Address to the 122nd Annual Henry George Commemorative Dinner

The Royal Society of Victoria, Melbourne

2nd, September 2013

by Saul Eslake

Introduction

I appreciate very much the opportunity to talk to you at the 122nd Annual Henry George Commemorative Dinner.Henry George was one of the more innovative economic thinkers of the 19th century, and it is in some ways a pity that his work is not better known among those who do know at least a little of the history of economic thought, as that of some of his contemporaries such as John Stuart Mill, William Stanley Jevons, or Alfred Marshall still is today.

I first ran across him when I was studying Australian History at Year 12, and focusing in particular on the Great Depression of the 1890s. I learned then that George’s advocacy of a single tax on the unimproved value of all privately-held land had found favour with sections of the then newly-emerging Australian labour movement.

Perhaps for that reason, those Australians who have actually heard of Henry George usually place him on the left of the political spectrum. Yet that is a gross over-simplification. He was also a strident advocate of restrictions on Asian immigration – as was the Australian Labor Party in its early days, and indeed right up until the 1960s – although these days, that is a position usually associated with the extreme right. Like most other economists, he was concerned about the existence and exploitation of monopoly power. And, also like most other economists, in his time and today, he was an advocate of free trade, pointing out that tariffs are not something that foreigners pay to get their goods into the country which imposes them, but rather something that a country’s government makes its own citizens pay in order to keep foreigners’ goods out: or, as he put it, “it is not from foreigners that protections preserves and defends us: it is from ourselves” (George 1905: 45-46).

Nor is the advocacy of a greater role for the taxation of land in taxation systems an exclusively left-of-centre position. Adam Smith, commonly if not entirely accurately regarded as the father of “laissez faire”, proposed what he called ‘ground rents’ as ‘a proper subject of taxation’ a century before Henry George (Smith 1776: Book V, Chapter 2). Milton Friedman – who in no sense could be characterized as being anywhere near left-of-centre (notwithstanding his principled advocacy of the decriminalization of drug use) – once said that, in his opinion “the least bad tax is the property tax on the unimproved value of land, the Henry George argument of many, many years ago” (Friedman 1978). The Economist – the antithesis of a ‘socialist rag’ – earlier this year stated that “taxing land and property is one of the most efficient and least distorting ways for governments to raise money”, citing an OECD study suggesting that “taxes on immovable property are the most growth-friendly of all taxes” (Economist 2013: 70).

The Henry Review of the Australian taxation system concluded that “land is an efficient tax base because it is immobile; unlike labour and capital, it cannot move to escape tax” and that “economic growth would be higher if governments raised more revenue from land and less revenue from other tax bases” (Henry 2009: 247). Henry George would have been pleased.

All of this notwithstanding, very few economists – and I am not one of them – would today accept that it would be either possible, or even if it were possible, desirable, for a land tax to be the sole source of government revenue, as Henry George advocated. He was writing at a time when government revenue requirements were substantially smaller than they are today; and when it was far less likely than it is today that people could be ‘asset rich but income poor’. But there is still a very sound case for the taxation of land to play a greater role in raising revenue for public purposes than it does today.

Housing policy: a half-century of policy failure

Housing is important. It meets a variety of deeply personal needs, including those for shelter and (ideally) security. It provides a sense of attachment (the place where we live) and, for many people, contributes to their sense of identity. These are pretty basic needs for almost all of us, as human beings. In addition, for many people, it is an important means of building wealth (and often the most important one); and for some, it provides the foundation for starting a business.In Australia, most of us are well-housed – at least in a physical sense. Although it hasn’t always been the case, and it isn’t the case for all Australians today (not least for Indigenous people), most of us live in houses or apartments that are well-constructed, amply fitted with various devices that make the accomplishment of household tasks easier than it was in our great-grandparents’ day, and replete with other appurtenances and chattels that in some way or other provide us with enjoyment or add meaning to our lives.

That isn’t the case in many other parts of the world. In July, I spent a week in Madagascar, which according to the IMF is the sixth-poorest country in the world, measured in terms of purchasing-power-parity per capita GDP. It ranks 151st (out of 186 countries) on the United Nations latest Human Development Index. People in Madagascar are not, in general, well housed. From my own observation, outside of the capital, Antananarivo, most people in Madagascar live in wooden or mud-brick huts that, in many cases, are smaller than the lounge room of a typical new Australian house, with roofs made of thatch, and in many cases without glazed windows. It puts our housing issues into a different perspective.

Reflecting the importance of housing to people’s well-being, as well as to many broader objectives, Australian Governments of all political persuasions have long purported to attach a great deal of significance to goals such as promoting home ownership, improving housing affordability, and increasing housing supply.

And, once upon a time, Australian Governments did actually pursue policies that promoted those objectives (see Charts 1 and 2):

- between 1947 and 1961, the housing stock increased by 50% -compared with a 41% increase in Australia’s population over this period. The Commonwealth and State Governments directly contributed 221,700, or 24% of the total increase in the housing stock over this period, through programs financed under the Commonwealth-State Housing Agreements, or under the War and Defence Service Homes Schemes.

- during this period, the home ownership rate increased from 53.4% to 70.3% -the largest increase in home ownership in Australia’s history.

- between 1961 and 1976, the housing stock increased by a further 46%

-again outstripping the 33% increase in Australia’s population over this

period. During this period, the Commonwealth and State Governments

directly added a further 299,000 dwellings to the housing stock,

equivalent to 23% of the increase in the total housing stock over this

period.

during this period, the home ownership rate fluctuated between 68% and 71%, but remained at a high level by international standards.

Chart 1: Growth in the population and housing stock, 1947-2011

Chart 2: Home Ownership rates accelerated post WW2

Chart 3: Home ownership rates at Censuses, 1947-2011

There were downsides to these policies, of course – in particular, many of the dwellings built by State housing authorities, and by the private sector, were poorly located from the standpoint of access to employment, lacked basic infrastructure and community services, and inadvertently served to concentrate socio-economic disadvantage. But they did ensure that a rapidly-growing population was at least adequately housed, and they gave many families an opportunity to gain a first foothold on the home ownership ladder that they would otherwise not have had.

Even between 1976 and 1991, the housing stock increased at a much faster rate – 41% than the population – 23% -although only 9% of dwelling completions during this period were by the public sector.

But the relationship between growth in the housing stock and population growth began to change after the early 1990s. Between 1991 and 2001, Australia’s population grew by 11.5% , while the housing stock grew by only 18.3% -less than 9 pc points more than the population. And between 2001 and 2011, while the population grew by 15.9%, the housing stock grew by only 15.2%. That is, over the past decade, the housing stock has grown at a slower rate than the population – for the first time since the end of World War II.

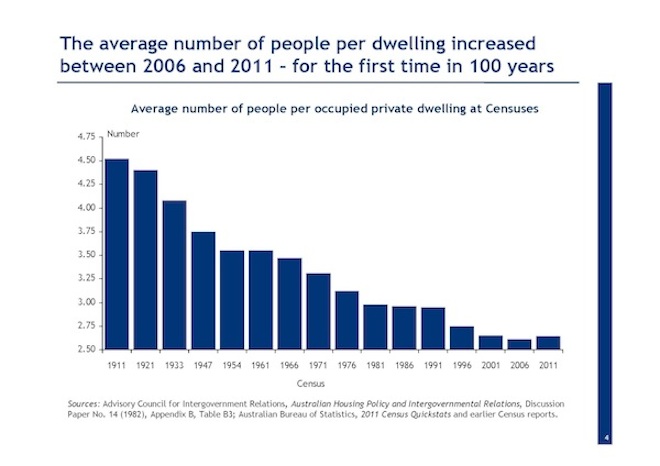

This gradual narrowing in the ‘gap’ between the growth rate of the housing stock and that of the population – to the point of eliminating it entirely over the past decade – has come in the face of demographic trends that would have warranted a widening of this gap:

- average family sizes declined between the early 1960s and the early 1990s, implying that more dwellings are required to accommodate the same number of people;

- family breakdowns have meant that more dwellings are required to accommodate the same number of people; and

- population ageing has resulted in more people living alone, again increasing the number of dwellings required to accommodate the same number of people.

Chart 4: Average number of people per dwelling at Censuses, 1911-2011

This is what the National Housing Supply Council, of which I’m a member, means when it estimates that Australia has a ‘shortage’ of housing relative to the ‘underlying’ demand for it – a shortage which it last estimated to be of the order of 228,000 dwellings as at 30 June 2011 (NHSC 2012: 24-25).

That 228,000 figure is not an estimate of the number of homeless people in Australia (which the ABS put at just over 105,000, a number which included 41,390 people living in ‘severely overcrowded’ dwellings, at the 2011 Census – ABS 2012). Rather, it reflects the gap between the existing housing stock, and what the Council estimates the stock would need to be if household formation patterns had remained essentially unchanged over the past decade.

In passing, I should note that these estimates pre-date the results of the 2011 Census, which has resulted in some downward revisions to the estimated level of Australia’s population compared with those which had been based on extrapolations from the 2006 Census, and which will lead to some consequential revisions to these estimates of the housing ‘shortage’.

However, it would be a mistake to think – as some other commentators have – that the revisions prompted by the 2011 Census results have eliminated the ‘housing shortage’ which the National Housing Supply Council and others had previously identified (see NHSC 2013: 107-123).

Nor, in my view, is the idea that there is a ‘housing shortage’ in the sense intended by the NHSC contradicted by the work that Philip Soos has undertaken for Earthsharing Australia, using data from Melbourne water suppliers to show that up to 6% of residential properties across the Melbourne metropolitan area may have been vacant during the second half of 2011 (Soos 2012).

If those vacant properties aren’t available (for whatever reason) for sale or rent then their existence does not detract from the existence of a housing shortage – although it may well be, as Philip argues, that an increase in land tax could prompt at least some of the owners of those properties to make them available for sale or rent.

I think there are two principal reasons for the increasing failure of the stock of housing to grow at a rate commensurate with the growth rate (and changing needs) of the population:

First, the direct contribution of the public sector to growing the housing stock has declined substantially. From the mid-1950s to the mid-1970s, public sector agencies completed an average of 15,512 new dwellings per annum (and they indirectly financed the completion of another 3,600 dwellings annually through low-interest loan schemes). From the mid-1970s to the early 1990s, they completed an average of 12,379 new dwellings per annum. But since then, they have completed an average of less than 6,000 new dwellings per annum (indeed between 1999 and 2009 the public sector built fewer than 4,000 new dwellings per annum, on average).

Second, state and local government planning schemes and policies for charging for the provision of suburban infrastructure have made it increasingly difficult for the private sector to supply new housing, especially at the more affordable end of the spectrum.

This second reason has three distinct dimensions.

First, state and local authorities have imposed increasingly more onerous requirements on developers for the provision of infrastructure and services in new housing estates. While that undoubtedly represents ‘progress’ in many respects – and certainly adds to the amenity of ‘greenfields’ developments from the perspective of those who move into them – it comes at a cost.

Second, local authorities have changed the way in which this infrastructure and these services are provided, from a model based on paying for them largely through debt, which was then serviced and repaid out of subsequent increases in rate revenues, to one based on paying for them through ‘up front charges’ on developers.

While this is consistent with a ‘user pays’ philosophy, and appeases the growing voter aversion to public debt, it has meant (especially in New South Wales, where developer charges have risen to much higher levels than in other States) that developers find it increasingly difficult to produce house-and-land packages at prices which are affordable for first-time buyers and still make a profit, so they have reacted by building a smaller number of more expensive houses targeted at the trade-up market.

Third, metropolitan planning authorities and inner-city local governments have made it increasingly more time-consuming and onerous to undertake higher-density or ‘infill’ developments on ‘brownfields’ sites – in particular by imposing tighter planning controls, and by providing more opportunities for objections to and appeals against planning decisions.

As with the more onerous requirements for infrastructure provision in ‘greenfields’ sites, there are two sides to this story, and I have a lot of sympathy with the desire of residents in established areas to prevent developments which detract materially from their quality of life (and/or from the value of their properties). But whatever perspective one might take on that debate, there is no doubt that developments in planning law have contributed to the mismatch between housing demand and housing supply.

What is also noticeable about the last twenty years is that – despite mortgage interest rates having been substantially lower, on average, over this period (7.59% pa over the past 20 years, compared with 11.95% over the preceding 20), and despite unprecedented expenditure on grants to first home buyers – the overall home ownership rate has actually declined by 5 percentage points, to 67% at the 2011 Census, its lowest figure since the 1954 Census.

In fact the decline in home ownership has been even more pronounced when one ‘looks through’ the effects of the ageing of the population, which (among other things) means that an increasing proportion of the population is within age groups where home ownership rates are always (and for obvious reasons) higher than in younger age cohorts.

Research by Judy Yates of the University of NSW shows that home ownership rates among younger age groups declined dramatically between the 1991 and 2011 Censuses – from 56% to 47% among 25-34 year olds; from 75% to 64% among 35-44 year olds; from 81% to 73% among 45-54 year olds; and 84% to 79% among those over 55. In fact the only age cohort among whom home ownership rates didn’t decline over the past 20 years was 15-24 year olds: but that was only because their home ownership rate had already fallen 34% in 1961 to 24% by 1991 and didn’t decline any further.

The decline in home ownership rates among younger age groups is almost certainly due in part to changing preferences (including partnering and having children at older ages, and greater importance attached to proximity to employment or entertainment venues): but it also undoubtedly owes more to declining affordability.

This is also evident in the fact that home owners are taking longer to pay off their mortgages. According to the ABS’ just-released Survey of Housing Occupancy and Costs (ABS 2013b), only 45.8% of home-owning households owned their home outright in 2011-12, compared with 58.5% in 1994-95.

Chart 5: Home ownership rates by age cohort, 19961-2011

This may be partly due to the fact that households can, and do, use mortgages for other purposes apart from simply acquiring the property which is mortgaged: but I think it is far more due to the fact that people need to borrow much more money initially in order to acquire a property now than they did 20 years ago.

So, when set against the stated objectives of the housing policies pursued by successive governments of various political persuasions, the results have been dismal.

Although most Australians are, as I noted at the beginning, physically well housed, it can no longer be said that we are, in general, affordably housed; nor can it be said that the ‘housing system’ is meeting the needs and aspirations of as large a proportion of Australians as it did a quarter of a century ago. And in making that assertion I am thinking of the extent to which the housing system meets the needs and aspirations of those who don’t want, or can’t and won’t ever be able to, become home-owners, as well as of those who do seek that status.

That is why I gave this talk the title, ‘Fifty Years of Failure’. In order to develop that proposition more fully, I want to turn now to two of the principal policies which governments of both persuasions have pursued throughout this period.

Assistance to first home buyers

It’s hard to think of any government policy that has been pursued for so long, in the face of such incontrovertible evidence that it doesn’t work, than the policy of giving cash to first home buyers in the belief that doing so will promote home ownership.The Commonwealth Government started giving cash grants to first home buyers in 1964 when, at the urging of the New South Wales Division of the Young Liberal Movement (whose President at the time was a young John Howard), the Menzies Government began paying Home Savings Grants of up to $500 to ‘married or engaged couples under the age of 36’ on the basis of $1 for every $3 saved in an ‘approved form’ (generally, with a financial institution whose major business was lending for housing) in the three years prior to buying their first home, provided that the home was valued at no more than $14,000.

This scheme was abolished by the Whitlam Government in 1973 (in favour of an income tax deduction for mortgage interest payments by persons with a taxable income of less than $14,000 per annum); re-introduced under the name of Home Deposit Assistance Grants (without the age or marriage requirements and the value limits, and with a larger maximum grant of $2,500) by the Fraser Government in 1976; replaced by the Hawke Government in 1983 with the First Home Owners Assistance Scheme, initially with a maximum grant of $7,000 (later reduced to $6,000) and subject to an income test; abolished by the Hawke Government in 1990; and then re-introduced as the First Home Owners Grant (FHOG) by the Howard Government in 2000, without any income test or upper limit on the purchase price of homes acquired, ostensibly as ‘compensation’ for the introduction of the GST (even though the GST only applied to the purchase of new homes, and not to existing dwellings which the majority of first-time buyers purchase). In this guise it was really just the first of what became an explosion in ‘status-based welfare’ payments to selected groups irrespective of needs during that decade. On two occasions since 2000, the FHOG has been temporarily increased in response to an actual or feared slump in housing activity (and in 2008, in response to a feared decline in house prices).

Over the past decade, most State and Territory Governments have ‘topped up’ the basic FHOG payments to first-time buyers with grants from their own resources, with some States providing even larger grants to buyers meeting certain additional criteria (for example, the Victorian Government provided an additional $5,000 for buyers of new homes in rural and regional areas).

I estimate that the Commonwealth, State and Territory Governments spent a total of $22.5bn (in 2010-11 dollar values) on cash grants to first home buyers between 1964 and 2011.

Chart 6: Explosion in status based welfare

State and Territory Government also provide indirect financial assistance to first-time buyers by partially or totally exempting them from the stamp duty they would otherwise pay on their purchases. In 2011-12 alone, these were worth around $3bn.

Chart 7: Spending on cash assistance to first home buyers, 1964-65 to 2011-12

Governments have thus been providing cash handouts to first-time home-buyers for almost half a century. Yet, as I mentioned earlier, the overall home ownership rate has never been higher than it was at the 1961 Census, immediately before governments started going down this path; and among the age groups which are supposedly most intended to benefit from these handouts, home ownership rates have declined almost vertiginously over the past two decades.

And it’s pretty obvious why. Cash grants and other forms of assistance to first-time home buyers have served simply to exacerbate the already substantial imbalance between the underlying demand for housing and the supply of it.

In those circumstances, cash handouts for first home buyers have simply added to upward pressure on housing prices, enriching vendors (and making those who already housing feel richer) whilst doing precisely nothing to assist young people (or anybody else) into home ownership. For that reason, I often think that these grants should be called ‘Existing Home Vendors’ Grants’ – because that’s where the money ends up – rather than First Home Owners’ Grants.

Encouragingly, perhaps – after what in my case has been more than 30 years of putting this kind of argument – State and Territory Governments appear at last to have gotten this message. Over the past 18 months or so, every State and Territory Government has either abolished or at least substantially reduced grants to first home buyers who buy existing dwellings, whilst increasing their grants to those who buy new ones, with a net effect of reducing the total spend on assistance to first home buyers.

I have no doubt that some of the increased grants to first time buyers of new homes will end up boosting developers’ or builders’ profits: but I accept that at least some of it will induce a supply side response to any resulting increase in demand for new homes, while considerably fewer taxpayers’ dollars will be wasted inflating the prices of existing homes.

‘Negative gearing’

Another long-standing policy which I have long argued has not only failed to deliver on its oft-stated rationale of boosting the supply of housing – in this case for rent – but has actually exacerbated the mis-match between the demand for and the supply of housing, as well as having distorted the allocation of capital, and undermined the equity and integrity of the income tax system, is so-called ‘negative gearing’.It is perhaps a telling indication of just how generous Australia’s tax system is to investors in this regard, compared with those of other countries, that one usually needs to explain to foreigners what the term ‘negative gearing’ actually means (see for example RBA 2003: 4045).

‘Negative gearing’ originally allowed taxpayers in effect to defer tax on their wage and salary income (until they sold the property or shares which they had acquired with borrowed money, on which they were paying more in interest than they received by way of dividends or rent). However, after the Howard Government’s 1999 decision to tax capital gains at half the rate applicable to other income (instead of taxing inflation-adjusted capital gains at a taxpayer’s full marginal rate), ‘negative gearing’ became a vehicle for permanently reducing, as well as deferring, personal tax liabilities. And the availability of depreciation on buildings adds to the way in which ‘negative gearing’ converts ordinary income taxable at full rates into capital gains taxable at half rates.

Chart 8: ‘Negative gearing’, 1993-94 to 2010-11

It’s therefore hardly surprising that ‘negative gearing’ has become much more widespread over the past decade, and much more costly in terms of the revenue thereby foregone (see Chart 6 above).

In 1998-99, when capital gains were last taxed at the same rate as other types of income (less an allowance for inflation), Australia had 1.3 million tax-paying landlords who in total made a taxable profit of almost $700mn. By 2010-11, the latest year for which statistics are presently available, the number of tax-paying landlords had risen to over 1.8mn (or 14% of the total number of individual taxpayers), but they collectively lost more than $7.8bn, largely because the amount they paid out in interest rose more than fourfold (from just over $5bn to almost $23bn over this period), while the amount they collected in rent ‘only’ slightly less than trebled (from $11bn to $30bn), as did other (non-interest) expenses.

If all of the 1.2mn landlords who in total reported net losses in 2010-11 were in the 38% income tax bracket, their ability to offset those losses against their other taxable income would have cost over $5bn in revenue foregone; to the extent that some of them are in the top tax bracket then the revenue loss is obviously higher.

This is a pretty large subsidy from people who are working and saving to people who are borrowing and speculating (since those landlords who are making ‘running losses’ on their property investments expect to more than make up those losses through capital gains when they eventually sell them).

And it’s hard to think of any worthwhile public policy purpose which is served by it. It certainly does nothing to increase the supply of housing, since the vast majority of landlords buy established properties: 92% of all borrowing by residential property investors over the past decade has been for the purchase of established dwellings, as against about 72% of all borrowing by owner-occupiers.

Precisely for that reason, the availability of ‘negative gearing’ contributes to upward pressure on the prices of established dwellings, and thus diminishes housing affordability for would-be home buyers.

Supporters of ‘negative gearing’ argue that its abolition would lead to a ‘landlord’s strike’, driving up rents and exacerbating the existing shortage of affordable rental housing. They repeatedly point to what they allege happened when the Hawke Government abolished negative gearing (only for property investment) in 1986 – that it ‘led’ (so they say) to a surge in rents, which prompted the reintroduction of ‘negative gearing’ in 1988.

This assertion is actually not true. If the abolition of ‘negative gearing’ had led to a ‘landlord’s strike’, as proponents of ‘negative gearing’ repeatedly assert, then rents should have risen everywhere (since ‘negative gearing’ had been available everywhere). In fact, rents (as measured in the consumer price index) only rose rapidly (at double-digit rates) in Sydney and Perth – and that was because in those two cities, rental vacancy rates were unusually low (in Sydney’s case, barely above 1%) before negative gearing was abolished. In other State capitals (where vacancy rates were higher), growth in rentals was either unchanged or, in Melbourne, actually slowed (see Chart 7).

Chart 9: Rents and vacancy rates in the mid-1980s

However, notwithstanding this history, suppose that a large number of landlords were to respond to the abolition of ‘negative gearing’ by selling their properties. That would push down the prices of investment properties, making them more affordable to would-be home buyers, allowing more of them to become home-owners, and thereby reducing the demand for rental properties in almost exactly the same proportion as the reduction in the supply of them. It’s actually quite difficult to think of anything that would do more to improve affordability conditions for would-be homebuyers than the abolition of ‘negative gearing’.

There’s no evidence to support the assertion made by proponents of the continued existence of ‘negative gearing’ that it results in more rental housing being available than would be the case were it to be abolished (even though the Henry Review appears to have swallowed this assertion).

Most other ‘advanced’ economies don’t have ‘negative gearing’: yet most other countries have higher rental vacancy rates than Australia does.

Chart 10: Rental vacancy rates in Australia and the United States

In the United States, which hasn’t allow ‘negative gearing’ since the mid-1980s, the rental vacancy rate has in the last 50 years only once been below 5% (and that was in the March quarter of 1979); in the ten years prior to the onset of the most recent recession, it has averaged 9.1% (see Chart 8 above).

Yet here in Australia, which does allow ‘negative gearing’, the rental vacancy rate has never (at least in the last 30 years) been above 5%, and in the period since ‘negative gearing’ became more attractive (as a result of the halving of the capital gains tax rate) has fallen from over 3% to less than 2%.

During that same period, rents rose at rate 0.8 percentage points per annum faster than the CPI as a whole; whereas over the preceding decade, rents rose at exactly the same rate as the CPI.

Similarly, countries which have never had ‘negative gearing’ – such as Germany, France, the Netherlands, the Nordic countries and (low-tax) Switzerland – have much larger private rental markets than Australia.

Some supporters of negative gearing also argue that since businesses can deduct all of the operating expenses they incur (including interest) against their profits in order to determine their taxable income, and can also ‘carry forward’ net losses incurred in any given year against profits earned in subsequent years so as to reduce the tax otherwise payable, it is only ‘fair and reasonable’ that investors should be able to do the same.

There are two flaws in this argument, in my view. First, a large part of the appeal of ‘negative gearing’ comes from the way in which it allows income which would otherwise have been taxed at the investor’s marginal rate effectively to be converted into capital gains, which are taxed at half the investor’s marginal rate. Businesses – if they are incorporated, as most businesses these days are – can’t do that. Companies aren’t eligible for the 50% discount on tax payable on gains on assets held for more than one year.

Second, while individuals are allowed to deduct expenses incurred in connection with producing investment income from their taxable income, they aren’t allowed to deduct many types of expenses incurred in producing wage and salary income.

To take an obvious example, wage and salary earners aren’t allowed to deduct the cost of travelling to and from work; nor are they allowed to deduct child care expenses.

Or, to take another example which may be an even closer analogy with ‘negative gearing’ for investment purposes, individuals aren’t allowed to deduct interest on borrowings undertaken to finance their own education as a tax deduction, even though that additional education may contribute materially to enhancing their future earnings – and even though any such additional future earnings will be taxed at that individual’s full marginal rate, as opposed to half that rate in the case of capital gains on an investment asset.

Let me be clear that I’m not advocating that ‘negative gearing’ be abolished for property investments only, as happened between 1986 and 1988. That would be unfair to property investors.

Personally, I think ‘negative gearing’ should be abolished for all investors, so that interest expenses would only be deductible in any given year up to the amount of investment income earned in that year, with any excess ‘carried forward’ against the ultimate capital gains tax liability, rather than being used to reduce the tax payable on wage and salary or other income (as is the case in the United States and most other ‘advanced’ economies).

But I’d settle for the recommendation of the Henry Review (2009, Volume 1: 72-75), which was that only 40% of interest (and other expenses) associated with investments be allowed as a deduction, and that capital gains (and other forms of investment income, including interest on deposits) be taxed at 60% (rather than 50% as at present) of the rates applicable to the same amounts of wage and salary income.

This recommendation would not amount to the abolition of ‘negative gearing’; it would just make it less generous than it is at the moment. It would be likely, as the Henry Review suggested, ‘to change investor demand toward housing with higher rental yields and longer investment horizons [and] may result in a more stable housing market, as the current incentive for investors to chase large capital gains in housing would be reduced’.

I could even accept the Henry Review’s recommendation that “these reforms should only be adopted following reforms to the supply of housing and reforms to housing assistance’ which it makes elsewhere, even though I disagree with the Henry Review’s concern that these reforms ‘may in the short term reduce residential property investment’.

I could also accept, grudgingly, that any of these changes could be ‘grandfathered’, in order to minimize opposition from those who already have negatively geared investments, and who would understandably see the modification or removal of ‘negative gearing’ without such a provision as directly disadvantageous to them.

However, the alacrity with which both major political parties moved to distance themselves from even these modest proposals in the Henry Review when it finally saw the light of day a few days before the 2009 Budget doesn’t provide much grounds for hope in that regard.

What could be done instead?

I’ve argued that two of the principal long-standing government interventions in the housing market – cash assistance to first-time home buyers and ‘negative gearing’ – have not only failed to achieve their stated objectives, but have actually exacerbated the difficulties facing those whom these interventions are supposed to assist:- they have served to inflate the demand for housing – and in particular, the demand for already-existing housing – whilst doing next to nothing to increase the supply of housing.

- they have therefore made housing affordability worse, not better.

- and to the extent that the ownership of residential real estate is concentrated among higher income groups – 36% of all property owned by individuals, and 47% of all property other than owner-occupied dwellings, is owned by households in the top 20% of the income distribution (ABS 2013c) – they exacerbate inequities in the distribution of income and wealth.

At the risk of appearing cynical – not that, in my experience, being cynical about the motivations of political parties and governments carries a serious risk of leading one into making erroneous predictions about what they might be– I think the answer is obvious. While political parties and governments profess to care about first home buyers, the reality is that in a typical year fewer than 100,000 people succeed in attaining home ownership for the first time; whereas there are some 5.8 million households (and over 8 million people) who already own at least one property. Hence there are 100,000 votes for policies which might result in lower house prices, and over 8 million votes against policies which might result in lower house prices (or in favour of policies which result in higher house prices). As the Americans say: ‘do the math’.

John Howard – who could ‘do the math’ better than most – often used to say that no-one ever came up to him complaining about the increase in the value of their home, or asking him to do things that would reduce the value of their homes so that younger people could buy them more readily.

Nonetheless, if by some chance a political party really did want to advocate and implement policies that really would stand some chance of improving the capacity of the Australian housing system to respond to the needs and aspirations of Australian citizens, what might they say?

The fundamental change that such a set of policies might embody would be a switch from policies which inflate the demand for housing to policies which boost the supply of housing. Such a suite of policies might include some or all of the following:

- first, the abolition of all existing policies which serve only to increase the prices of existing dwellings, such as cash grants to and stamp duty exemptions for first time buyers, and ‘negative gearing’ for investors (in all assets, not just property, and if politically necessary, only for assets acquired after the date on which such a policy was announced);

- second, the redirection of the funds thereby saved (and/or the additional revenue raised) towards programs that increase the supply of housing – for example, by directly funding the construction of new dwellings (as the Rudd Government did as part of its response to the global financial crisis), or by providing some combination of grants, loans or tax incentives to induce private sector developers to increase the proportion of ‘affordable’ dwellings within their developments, whether for sale or rental;

- third, expanding or replicating programs like Western Australia’s ‘Keystart’ scheme which assist eligible people to become home owners on a ‘shared equity’ basis, with eligibility being subject to a means test, and which creates a ‘revolving fund’ as the ‘shared equity’ is returned to the State Government upon sale;

- fourth, changes to the way in which State and Territory Governments tax holdings of and transactions in land, with a view to encouraging more efficient use of it. That would include replacing stamp duty on land transfers (which are ‘bad’ taxes on many grounds, including that they discourage people from changing their dwellings as their needs change) with more broadly-based land taxes (ie, no exemptions for owner-occupiers, but with appropriate transitional provisions) and possibly higher rates for undeveloped vacant land in established urban areas;

- fifth, taking a more ‘holistic’ view of urban infrastructure investment, by recognizing that it has an important housing dimension – that is, that public (or private) investment in transport infrastructure (both public transport and roads) can make a tangible contribution towards improving housing supply and affordability by making ‘greenfields’ developments more accessible to both buyers and renters – and considering funding such infrastructure by levies on the increments to the value of the land which result from such investments (as for example with the levy that funded the Melbourne Underground Rail Loop Authority in the 1970s and early 1980s);

- sixth, revisiting current models for financing the provision of infrastructure and services in ‘greenfields’ housing estates with a view to reducing the extent to which these are funded by ‘upfront’ charges (something which could be assisted by changes to the land tax regime which I mentioned a moment ago); and

- seventh, reducing the cost, complexity and regulatory uncertainty associated with ‘brownfields’ and ‘infill’ developments in established areas – which doesn’t have to mean traducing the property rights of other property owners, but which should mean clearer and more uniform planning rules, with fewer opportunities for frivolous or vexatious objections and appeals. Note that I am not advocating something that is often widely assumed to find favour with economists – namely, the removal of the exemption of owner-occupied housing from capital gains tax. I don’t favour that, because consistency with other parts of the tax system would require that mortgage interest payments be deductible. That would in turn almost certainly encourage people to take on more debt, and would thus inflate the demand for housing, putting further upward pressure on prices. And it could well end up being revenue negative.

No comments:

Post a Comment