What happens from here remains to be seen. But property investors represent a clear risk to the ‘slow melt’ of Australian housing if they became widespread sellers of their loss-making investments.

Great Article Origionaly Posted by: (http://www.macrobusiness.com.au/2011/08/will-they-cut-and-run/) Unconventional Economist in Oz Housing Bubble on Aug 11th, 2011

Two recent articles in Fairfax contained some interesting discussion about the implications of negatively gearing and the Baby Boomers’ impending retirement on the Australian housing market.

The first article by Gittins! summarises the motivations behind, and implications of, the Baby Boomers’ mass accumulation of investment properties since the 1990s:

Certainly, the idea of holding an investment currently earning a net yield of around 3% when interest costs are tracking around 7% during a period of stagnant capital growth is unappealing, and logic would dictate that many negatively geared investors would grow tired of the constant cash drain and sell-up to avoid incurring more losses.

But whether this logical scenario plays-out in practice remains to be seen. As the great Isaac Newton once proclaimed after losing his fortune on the South Sea Bubble: “I can calculate the motions of heavenly bodies but not the madness of men”.

Still, the statistics on negatively geared property investment in Australia are staggering.

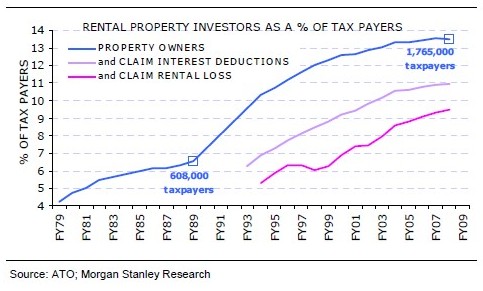

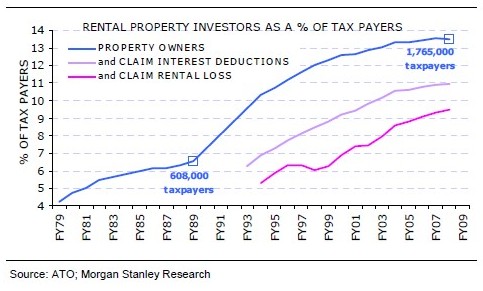

First, there’s the rapid growth of property investment over the past 30 years (chart from Morgan Stanley).

Second, the percentage of property investors claiming a rental loss has increased significantly, driven by house prices increasing at a faster rate than rents (chart from Morgan Stanley):

While the charts are a little old, and exclude data from the most recent ATO Taxation Statistics (see here for more recent analysis), the explosion of property investors – from around 4% of taxpayers in 1979 to 13% as at 2008 – is stunning, as is the increase in the percentage of investors claiming a loss. Moreover, the acceleration in property investment from 1990, coincident with the Baby Boomers reaching peak earnings age (45 to 55 years old), is clearly evident.

Alarmingly, around half of property investment loans are interest-only, which both reduces the amount of equity accumulation and increases potential losses from adverse price movements, raising the likelihood of forced sales (chart from Westpac):

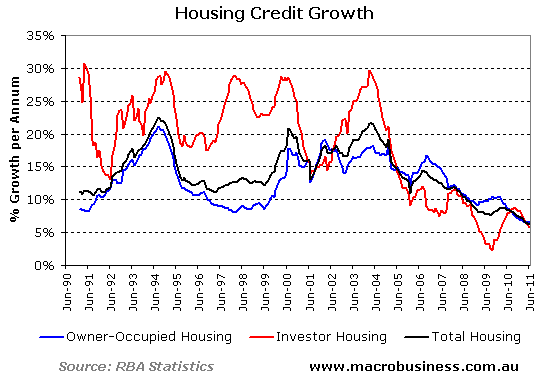

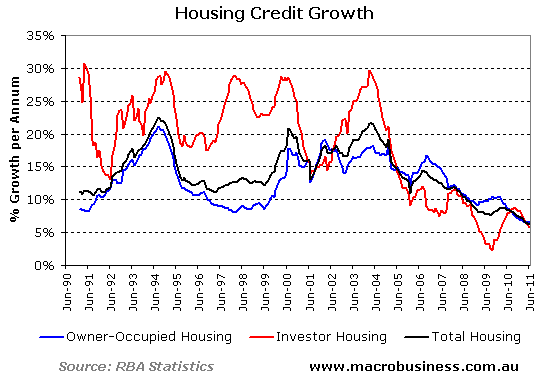

After the small rebound following the stimulus-fuelled surge of first home buyers in 2009, appetite for investment property once again appears to be waning. Whereas investor credit grew at annual rates of between 15% and 30% in the 15 years to 2005, it is growing at only 6% currently:

Two recent articles in Fairfax contained some interesting discussion about the implications of negatively gearing and the Baby Boomers’ impending retirement on the Australian housing market.

The first article by Gittins! summarises the motivations behind, and implications of, the Baby Boomers’ mass accumulation of investment properties since the 1990s:

Back in the early Noughties, when the property market was booming, a lot of baby boomers began contemplating their future and realised they hadn’t saved nearly enough to allow them to continue in retirement the privileged lives they’d always enjoyed. They decided they’d have to start saving big time.

So what did they do? Went out and bought a negatively geared investment property, of course. Their notion of saving was to borrow to the hilt, then sit back and wait for the lightly taxed capital gains to roll in…

For most of the decade in question [the decade to 2005], we fought each other for the best house in the block, forcing house prices up and up…

Everywhere we turned we could see ourselves getting wealthier, year after year. The value of our homes rising inexorably, the value of our super swelling nicely. With all that going for us, who needed to save the old-fashioned way? No wonder negative gearing – of share portfolios as well as residential property – was so popular…

As for house prices, the boom is long gone and prices are, in market parlance, ”flat to down”. There’s no reason to believe they’ll be taking off again any time soon.

Gittins!’ article was followed-up a week later by Fairfax’s Ian Verrender, who touched on the risk of falling property prices causing forced sales from negatively geared investors:

Australian real estate enjoyed a prolonged boom through the 1990s until 2008 fuelled by cheap and easy credit.Whether Australia’s army of loss-making property investors will sell-up en masse in the face of a prolonged period of flat to falling home prices is one of the big unknowns facing the Australian housing market.

That credit boom has come to an abrupt halt. During the past 12 months, credit growth for housing has been the weakest in 40 years, ever since the Reserve Bank began compiling the data. Not surprisingly, housing prices have begun to weaken.

A market analyst, Greg Canavan, author of the Sound Money, Sound Investments newsletter, reckons the number of negatively geared investment properties purchased during the boom, many of them on 100 per cent loan-to-value ratios, will soon begin to slip into negative equity.

Negative gearing only works when capital values are rising. Right now they are not. That has the potential to produce forced sales of investment properties and a rise in bad debts among the banks.

Certainly, the idea of holding an investment currently earning a net yield of around 3% when interest costs are tracking around 7% during a period of stagnant capital growth is unappealing, and logic would dictate that many negatively geared investors would grow tired of the constant cash drain and sell-up to avoid incurring more losses.

But whether this logical scenario plays-out in practice remains to be seen. As the great Isaac Newton once proclaimed after losing his fortune on the South Sea Bubble: “I can calculate the motions of heavenly bodies but not the madness of men”.

Still, the statistics on negatively geared property investment in Australia are staggering.

First, there’s the rapid growth of property investment over the past 30 years (chart from Morgan Stanley).

Second, the percentage of property investors claiming a rental loss has increased significantly, driven by house prices increasing at a faster rate than rents (chart from Morgan Stanley):

While the charts are a little old, and exclude data from the most recent ATO Taxation Statistics (see here for more recent analysis), the explosion of property investors – from around 4% of taxpayers in 1979 to 13% as at 2008 – is stunning, as is the increase in the percentage of investors claiming a loss. Moreover, the acceleration in property investment from 1990, coincident with the Baby Boomers reaching peak earnings age (45 to 55 years old), is clearly evident.

Alarmingly, around half of property investment loans are interest-only, which both reduces the amount of equity accumulation and increases potential losses from adverse price movements, raising the likelihood of forced sales (chart from Westpac):

After the small rebound following the stimulus-fuelled surge of first home buyers in 2009, appetite for investment property once again appears to be waning. Whereas investor credit grew at annual rates of between 15% and 30% in the 15 years to 2005, it is growing at only 6% currently:

No comments:

Post a Comment